Comparing rates from different providers saves money.

Higher deductibles reduce SR22 insurance premiums.

Annual payments are often cheaper than monthly.

Comparing rates from different providers saves money.

Higher deductibles reduce SR22 insurance premiums.

Annual payments are often cheaper than monthly.

Discounts are available for safe driving courses.

Lowering coverage limits can decrease insurance rate

You can't cancel SR22 insurance at any time, as it requires a formal SR22 cancellation process, understanding

SR22 insurance TN insurance implications to avoid penalties. Understanding SR22 insurance in Tennessee (SR22 Insurance Providers TN)., (Understanding SR22 insurance in Tennesse

You've got the lowdown on Tennessee's SR22 insurance requirements. Curiously, 1 in 5 drivers who need SR22 insurance don't renew it, resulting in further penalties. By comparing rates and understanding the filing process, you'll save on premiums, so don't wait - get the best deals before they're gone and avoid unnecessary cost

Because Tennessee drivers have numerous options for SR22 insurance, it's vital to research and compare rates from multiple providers to find the best fit for your needs. You'll want to contemplate various insurance providers that offer SR22 insurance, as they may have different coverage options and pricing structures. When evaluating insurance providers, you should look at their financial stability, claims processing, and customer servic

Finding affordable SR22 insurance in Tennessee requires researching and comparing rates.

SR22 Insurance Providers TN from multiple providers. You're looking for affordable options that fit your budget planning needs. To accomplish this, you'll need to understand the factors that influence SR22 insurance rates, such as your driving record and vehicle ty

You've learned to save on SR22 insurance in TN.Interestingly, 1 in 5 drivers overpay for it (SR22 Insurance Agency Tennessee). By applying these tips, you won't be one of them, potentially saving hundreds of dollars annually on your premiu

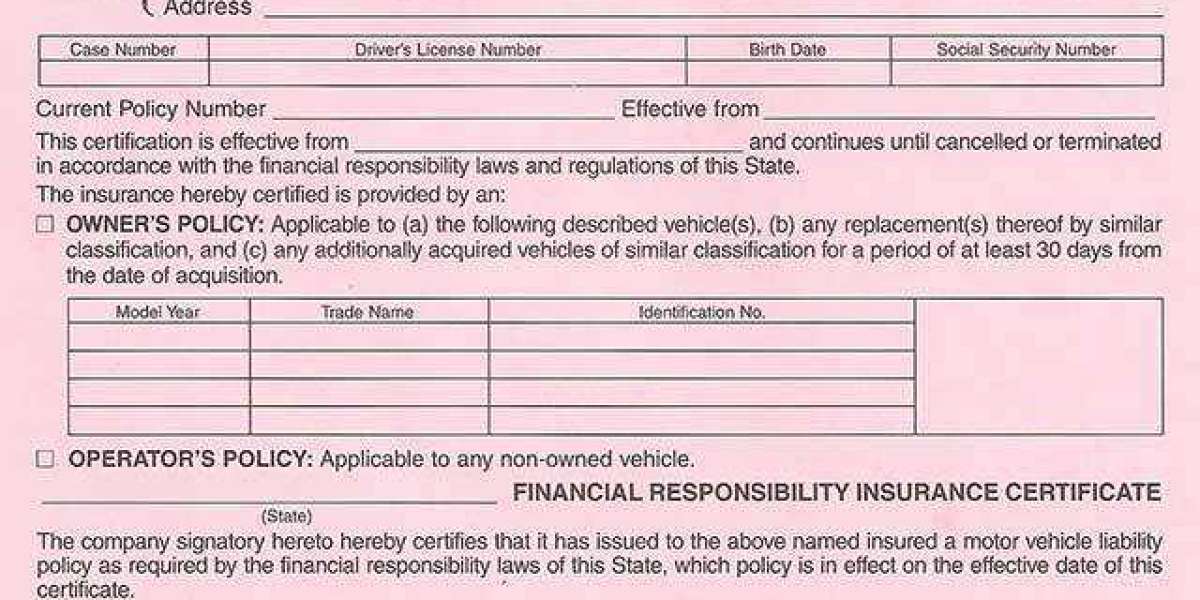

You'll need to understand the different types of insurance available in Tennessee, including liability, collision, and extensive coverage. As you research SR22 insurance deals, you should familiarize yourself with state laws governing insurance, such as the minimum coverage requirements and penalties for non-compliance. You must comply with Tennessee's insurance laws, which regulate the insurance industry and protect consumers, and it is crucial to know how these laws impact your insurance option

Several insurance companies in Tennessee offer cheap SR22 options, including State Farm, Geico, and Progressive, which can provide rates as low as $25 per month. You can compare quotes from these companies to find the best cheap premiums for your needs. When shopping for cheap SR22 insurance, you'll want to evaluate budget-friendly options that still meet Tennessee's minimum coverage requirement

Insurance companies often offer discounts to drivers who meet specific criteria, and securing these discounts can greatly lower SR22 premiums. You can check with your insurance provider to determine your discount eligibility, which may be based on driver demographics - personal automobile liability insurance policy such as age, location, or driving histo

You'll need to provide proof of insurance to the state, which is where the SR22 form comes in. This form certifies that you have the required insurance coverage. By choosing a cheap SR22 option, you can get back on the road quickly and easily. You'll be able to find affordable rates that fit your budget, and you won't have to break the bank to get the coverage you need (Low-cost SR22 policies Tennessee). With cheap premiums and budget-friendly options, you can get the insurance you need to drive safely and legally in Tenness

Someone seeking cheap SR22 insurance rates in Tennessee can obtain fast quotes from multiple providers to compare prices. You'll be able to review and analyze the quotes to determine which provider offers the best rate for your needs. This process allows you to make an informed decision, ensuring you get the coverage you require without overpaying. By comparing fast quotes, you can identify the most affordable option and proceed with purchasing a policy that meets your requirement

You can't cancel SR22 insurance anytime, as it requires a formal SR22 cancellation process, understanding SR22 insurance implications, and notifying authorities to avoid penalties and guarantee safety compliance (SR22 Insurance Providers TN). personal automobile liability insurance poli

To comply with state regulations, you must maintain SR22 filing for a specified period, usually three years. During this time, your insurance company will notify the Tennessee Department of Safety if your policy lapses or is canceled. It's vital to understand that SR22 filing is not an insurance policy itself, but rather a certificate of financial responsibility. You'll need to purchase a policy that meets the state's minimum liability requirements, which include bodily injury and property damage coverage. By fulfilling the SR22 insurance requirements, you can reinstate your driving privileges and guarantee you're complying with Tennessee's state regulation