The SR22 duration varies depending on the offense, but it is generally required for 3-5 years.

The SR22 duration varies depending on the offense, but it is generally required for 3-5 years. During this time, you must maintain continuous insurance coverage (licensed) and notify the DMV if your policy is cancelled or lapses. If you fail to comply, you'll face additional penalties -

sr22 insurance quotes tn and may have your license suspended again. It's crucial to understand the SR22 laws and requirements to avoid any further complications and guarantee your safety on the road. By following these laws, you can reinstate your driving privileges and maintain a safe driving reco

When you're labeled as a high-risk driver, finding affordable insurance can be challenging, but you have options. You can investigate different insurance providers that specialize in high-risk insurance. licensed. These providers offer various plans and rates, so it's crucial to compare them to find the best fit for y

Like Pandora's box, you're unsure what's covered, but you'll find SR22 coverage typically doesn't extend to other drivers, only you, as an SR22 driver, are covered under this specific policy requirement. certificate of insuranc

SR22 insurance proves minimum required coverage.

Filings are required after serious traffic violations.

Tennessee SR22 laws mandate 3-5 year coverage.

High-risk drivers can find specialized insurance providers.

Shopping around helps save on SR22 premium

You can't cancel SR22 insurance anytime, understanding the SR22 cancellation process and its implications is essential to avoid penalties, you're obligated to maintain it until requirements are met. - licens

Review your policy regularly to guarantee it's active and up-to-date

Notify your insurer of any changes to your vehicle or driving record

Keep track of your policy's expiration date to avoid lapses in coverage

Understand the terms of your policy, including any restrictions or requirements

Stay informed about Tennessee's SR22 insurance laws and regulations

You must prioritize policy maintenance and follow compliance tips to maintain SR22 insurance compliance. By doing so, you'll be able to avoid any issues and guarantee you're meeting the state's requirements. This will help you stay safe on the road and avoid any further penaltie

You'll need to understand Tennessee's SR22 requirements, including mandatory filing and minimum liability insurance. You're researching authorized insurers to compare rates and find the best coverage at a lower cost. Comparing quotes from multiple providers and evaluating discounts, such as good driver or defensive driving course discounts, can help. sr22 insurance quotes tn. By analyzing your driving habits and vehicle factors, you can reduce premium costs. SR22 insurance filing in Tennessee. You'll find that maneuvering these options efficiently is key to getting cheap SR22 insurance in Tennessee, and exploring these strategies further can help you make an informed decisi

Bundle policies: Combine your SR22 insurance with other policies, like auto or home insurance.

Improve your credit score: A better credit score can lead to lower insurance rates.

Choose a higher deductible: Paying more out-of-pocket for claims can reduce your premium.

Install safety devices: Adding safety features to your vehicle can make you eligible for discounts. By taking these steps, you can lower your SR22 insurance costs and guarantee you're getting the best coverage for your needs. Making informed insurance comparisons will help you find the most affordable option.

- licensedFrequently Asked Questio

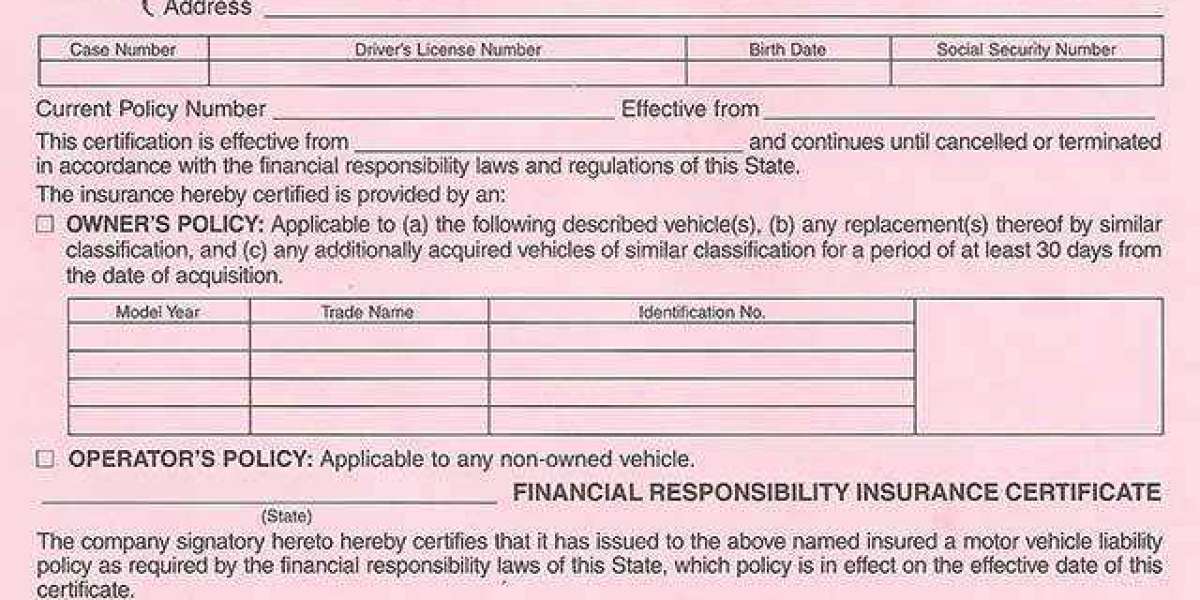

Most drivers in Tennessee don't need SR22 insurance, but if you've had a serious traffic violation, you'll likely require it. You're probably wondering what SR22 insurance is and how it affects you. The SR22 definition is a certificate of financial responsibility that proves you have the minimum required insurance coverage (licensed). It's not a type of insurance itself, but rather a filing that's added to your existing poli

n Provider A

Basic, Premium

$100-$300 Provider B Basic, Premium, Full

$150-$400

Provider C

Basic, Premium $80-$250

Provider D Full

$200-$500

Provider E

Basic, Premium

$120-$3

The SR22 duration varies depending on the offense, but it is generally required for 3-5 years. During this time, you must maintain continuous insurance coverage (licensed) and notify the DMV if your policy is cancelled or lapses. If you fail to comply, you'll face additional penalties - sr22 insurance quotes tn and may have your license suspended again. It's crucial to understand the SR22 laws and requirements to avoid any further complications and guarantee your safety on the road. By following these laws, you can reinstate your driving privileges and maintain a safe driving reco

Tennessee's SR22 laws dictate the requirements you must follow to reinstate or maintain your driving privileges. licensed after a suspension or revocation. You're required to file an SR22 form with the Tennessee Department of Motor Vehicles, which certifies that you have the minimum liability insurance coverage. Failure to comply with these requirements can result in Tennessee penalties, including fines and further license suspensi