You'll find SR22 isn't typically available online, but you're completing the SR22 application process through authorized SR22 insurance providers, who'll guide you through the requirements and.

You'll find SR22 isn't typically available online, but you're completing the SR22 application process through authorized SR22 insurance providers, who'll guide you through the requirements and necessary steps. (SR22 auto insurance in T

As you research SR22 insurance options in Tennessee, you'll find that costs can vary greatly depending on several factors, including your driving history, age, and location. You'll need to take into account sr22 insurance penalties and sr22 insurance duration when calculating your overall costs. The duration of your SR22 insurance can impact your premiums, with longer durations often resulting in higher cost

When comparing rates, you'll notice that location plays a significant role in determining your premium. You can save money by opting for a higher deductible or dropping unnecessary coverage. Additionally, having a good driving record and installing safety features in your vehicle can also lead to lower rates (personal automobile liability insurance policy). By doing your research and comparing rates, you can find affordable tn auto insurance that meets your needs and budg

Tennessee's SR22 insurance requirements are rooted in the state's legal codes, which outline the specific laws and regulations governing driver responsibilities and insurance coverage. You'll find these laws outlined in the Tennessee statutes, which provide detailed information on the legal implications of non-compliance. SR22 auto insurance in TN. As you maneuver through these requirements, it's crucial to understand the legal codes that govern SR22 insurance in Tenness

How can you minimize the financial burden of SR22 insurance in Tennessee? You're looking for ways to reduce costs without compromising your safety on the road. One approach is to investigate discount programs - personal automobile liability insurance policy offered by insurance providers. These programs can help you save money, and you should ask about them when shopping for

SR22 insurance TN insuran

License suspension: Failure to file an SR22 form can result in license suspension.

Should you cherished this post along with you desire to receive more info with regards to

Cheap sr22 insurance tennessee kindly pay a visit to the website. Insurance rate increases: SR22 filings can lead to higher insurance rates.

Policy cancellations: Insurers may cancel your policy if you don't maintain SR22 requirements.

You should carefully review Tennessee's requirements to avoid any issues with your insurance eligibility. By understanding the state's regulations and SR22 implications, you can guarantee you're in compliance and maintain your driving privileges. This knowledge will help you steer through the process and make informed decisions about your insurance coverag

You can save time and money on SR22 insurance in Tennessee by shopping around and comparing rates from different insurance companies (personal automobile liability insurance policy). This approach allows you to identify cost-effective strategies that fit your budget. By researching and comparing quotes, you'll be able to find the best rates for your specific situati

n Driving History

Higher premiums for accidents or tickets

Age

Younger drivers may pay more for SR22 insurance

Location

Urban areas tend to have higher premiums than rural are

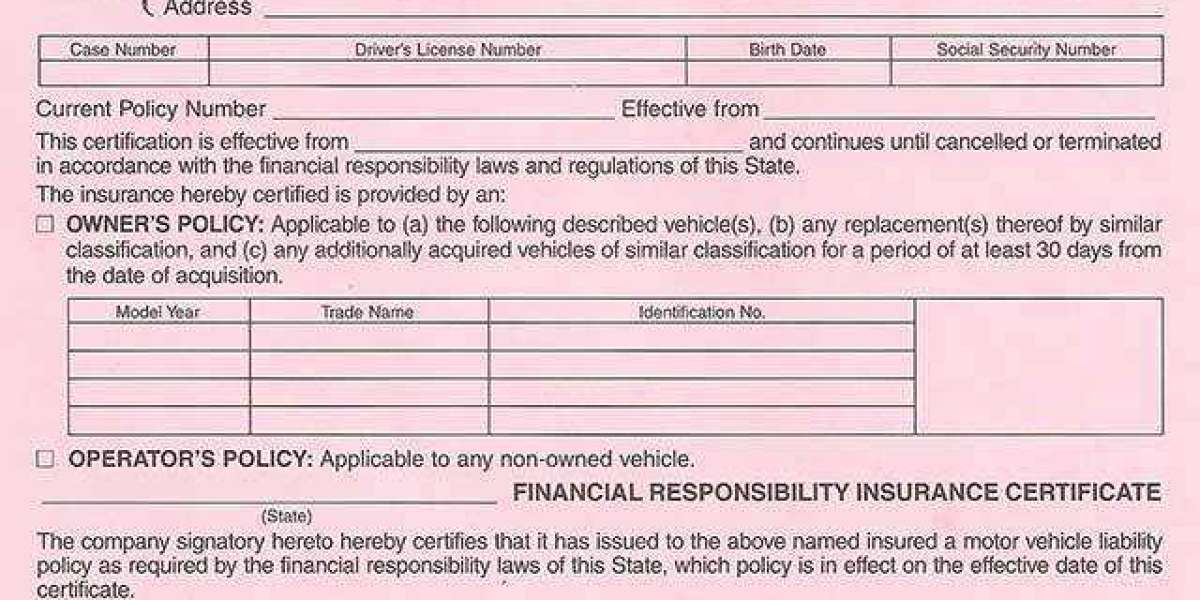

Because you're likely looking for cheap SR22 insurance in Tennessee, it's vital to understand what SR22 requirements entail. You'll need to file SR22 forms -

SR22 insurance TN insurance filing in Tennessee with the state, which verifies that you have the necessary insurance coverage. This requirement is usually mandatory after a driving offense, such as a DUI or reckless driving. You must comply with state regulations, which dictate the minimum liability insurance you need to car

You'll also need to determine your policy limits, which is the maximum amount your insurer will pay in case of a claim. Higher policy limits provide greater financial protection, but they also increase your premium. It's vital to strike a balance between coverage and affordability. You should assess your financial situation and choose policy limits that align with your needs. By carefully evaluating coverage types and policy limits, you can create a customized SR22 insurance policy that meets Tennessee's requirements and provides you with peace of mind while driving. This helps guarantee you're adequately protected in case of an acciden

You can't drive other cars with SR22 unless they're listed, as SR22 requirements don't include exemptions for non-listed vehicles, ensuring you're covered and safe. (personal automobile liability insurance polic

You should research each provider's reputation, checking for reviews and ratings from current customers. A provider with a strong reputation is more likely to provide reliable insurance coverage. By comparing providers and considering their strengths and weaknesses, you can make an informed decision and choose the best SR22 insurance for your needs in Tennesse

You can't cancel SR22 insurance until you've completed the required period, but you're contacting SR22 insurance providers to initiate the SR22 cancellation process, they'll guide you through it. (personal automobile liability insurance polic